The Rise of Fully Electric Construction Equipment: An In-depth Analysis

The construction industry, globally, and in the US, is experiencing a shift towards sustainable practices, with fully electric construction equipment emerging as a key player.

Listen Now (AI-Powered):

This podcast is generated using NotebookLM technology.

The current market for fully electric construction equipment is characterized by rapid innovation and increasing competition among major manufacturers. Companies like Caterpillar, Volvo, Komatsu, and JCB are leading the charge with their latest electric models. The market is seeing a growing number of partnerships between OEMs and battery technology companies to enhance the efficiency and performance of electric construction machinery. It seems that the success of these collaborations will be the key to convincing the construction industry that electric construction equipment is a viable and effective equipment solution in the future.

This blog looks at a detailed analysis from the recent survey by Bazis Build team, conducted among US construction equipment decision makers. The survey explores the awareness, adoption, challenges, and future outlook of electric construction equipment. In addition, we will examine the current market and possible future implications of electric construction equipment.

Findings from Bazis Survey (July 2024)

Awareness of Fully Electric Construction Equipment

When looking at the awareness level construction professionals of Original Equipment Manufacturers (OEMs) offering fully electric construction equipment, the results indicate that a significant portion of respondents are aware of prominent brands such as Caterpillar, Volvo, and others that are making strides in this domain. Awareness sets the stage for broader acceptance and adoption of these innovative machines.

An interesting point is that 22% knew about electric construction equipment but did not know any specific OEMs that offered them.

Likelihood of Adoption

We asked respondents on a scale from 1 to 100% how likely they were to purchase electric construction equipment.

This suggests a cautious approach, possibly due to concerns about performance, cost, and reliability. Standard deviation was high, indicating diverse opinions among respondents.

Current Adoption Rates

The data revealed that the majority have not yet purchased fully electric construction equipment. The main barriers include high initial costs and limited availability of equipment. Interestingly, long-term cost savings and lower maintenance costs were recognized as significant benefits, highlighting a gap between perceived and actual barriers.

There are some potential motivators that could drive adoption of electric construction equipment. Yet, respondents also see significant barrier to adoption.

Potential Motivators

Government Incentives:

Subsidies and tax breaks could offset the high initial costs.

Technological Advancements:

Improvements in battery technology and charging infrastructure would alleviate many performance concerns.

Environmental Regulations:

Stricter emissions regulations could push companies towards adopting greener alternatives.

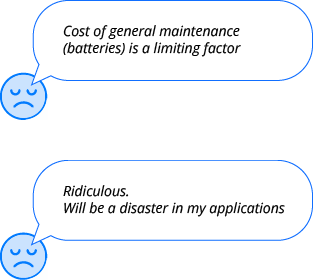

Barriers to Adoption

High Initial Costs:

The upfront investment required for electric machinery is significantly higher.

Limited Infrastructure:

Inadequate charging infrastructure and battery technology concerns are major roadblocks.

Performance Uncertainty:

There is skepticism about the performance and reliability of electric equipment compared to traditional diesel-powered machines.

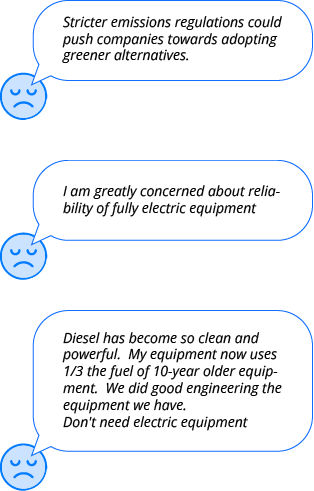

Construction workers are skeptical

While the immediate adoption rates seem low, the long-term outlook is more optimistic. About 37% of respondents indicated they are somewhat likely to consider electric equipment in the near future. This is driven by anticipated technological advancements and regulatory pressures.

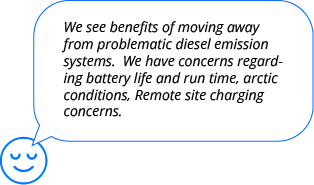

When respondents had discussions with industry piers the conversations often revolve around the benefits of moving away from fossil fuels, with particular emphasis on long-term cost savings and environmental impact. However, there is also a big segment that remains skeptical, viewing electric equipment as impractical particularly types of work.

Here is what our respondents had to say:

Skeptical and Cautious:

Optimistic but with Operational Concerns:

Broader Industry Outlook

Moving from our survey results to a broader industry analysis, we have identified three key factors that are driving the electric construction equipment market.

1. First, the construction industry is under increasing pressure to reduce carbon emissions and adopt more sustainable equipment.

2. To expedite the switch, governments around the world are introducing incentives to promote the adoption of fully electric equipment and machinery. These incentives include tax breaks, grants, and subsidies, making electric construction equipment more financially feasible.

3. The third factor relates to advances in battery technology are improving the range, efficiency, and charging times of electric construction equipment. This is making electric equipment options more competitive with traditional diesel-powered equipment.

Market challenges mentioned by our respondents are echoed in wider industry discussions. Here are three challenges that may prevent quick adoption.

Cost remains the #1 barrier for many companies, particularly smaller contractors. Initial purchase price of electric construction equipment is significantly higher (20 to 30%) than that of traditional equipment.

This is particularly challenging for projects in remote or electrically underserved worksites. Finally, there is still a perception that electric equipment cannot match the performance and reliability of diesel equipment. Overcoming this perception is crucial for broader adoption.

Several innovations are addressing these challenges. For example, manufacturers are developing swappable battery systems to reduce downtime and increase the flexibility of electric construction equipment. Another innovative solution introduces hybrid construction equipment, which combines electric and traditional power sources, is emerging as a solution.

Conclusion

The move to fully electric construction equipment is still in its fledgling stages, with awareness and interest gradually building. While there are barriers to overcome, the potential benefits in terms of cost savings, environmental impact, and compliance with future regulations make a strong case for the construction industry to continue exploring and investing in electric construction equipment.

As technological advancements continue and infrastructure improves, it is likely that the adoption rates will increase, paving the way for a more efficient and sustainable construction industry. The path may be challenging, but the destination promises a more cost effective, greener and resilient future.